Benefit:

Reduce time and effort to comply with payroll regulatory reporting requirements relating to COVID-19 pay.

...

If your company has employees who received wages that were part of the COVID-19 Sick and/or Childcare Act, you must upgrade to AGRIS 20.3.0 service update 2 (or higher) in order to print this on the W-2.

...

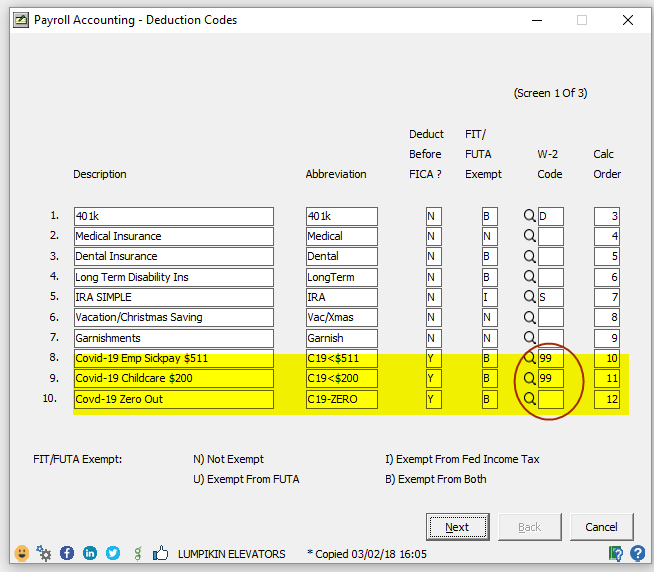

Set up a deduction code for the Covid-19 Personnel Sick pay Limited to $511. - C19<$511

PAY > Setup Information > Deduction Code

Deduct Before Fica? = Yes

FIT/FUTA Exempt? = B-exempt from Both

W-2 Code = 99 (Note that this is an new enhancement released with 20.3.0.2)

This 99-code is how we are directing this to print in Box 14 of the W-2

Calc Order = whatever the next number is in the listSetup a deduction code for the Covid-19 Childcare Stick Pay limited to $200/day - C19<$200

PAY > Setup Information > Deduction Code

Deduct Before Fica? = YES

FIT/FUTA Exempt? = B-exempt from Both

W-2 Code = 99 (Note that this is an new enhancement released with 20.3.0.2)

This 99-code is how we are directing this to print in Box 14 of the W-2

Calc Order = whatever is availableSetup a deduction code for the Covid-19 Zero-Out - C19-ZERO

PAY > Setup Information > Deduction Code

Deduct Before Fica? = YES

FIT/FUTA Exempt? = B-exempt from Both

W-2 Code = leave blank

Calc Order = whatever is availableState Code Setup

(if this needs to be added to state income, repeat steps above on state tax setup.)

pay > Payroll Tax Tables > State/Local Tax TableVerify or add a new state tax table ZZ - called YR. END ADJUSTMENT

Payroll > Payroll Tax Tables > State/Local Tax Tables

Give the code a name that represents their location since this description of ZZ does print on the W-2.

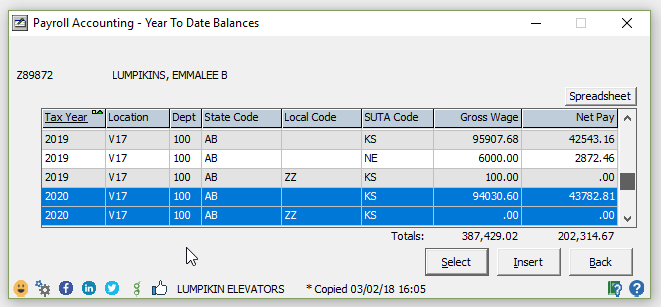

For Example, “Smithville-Yr End Adjustment”Insert a new YTD balance for tax year with ZZ as the local code.

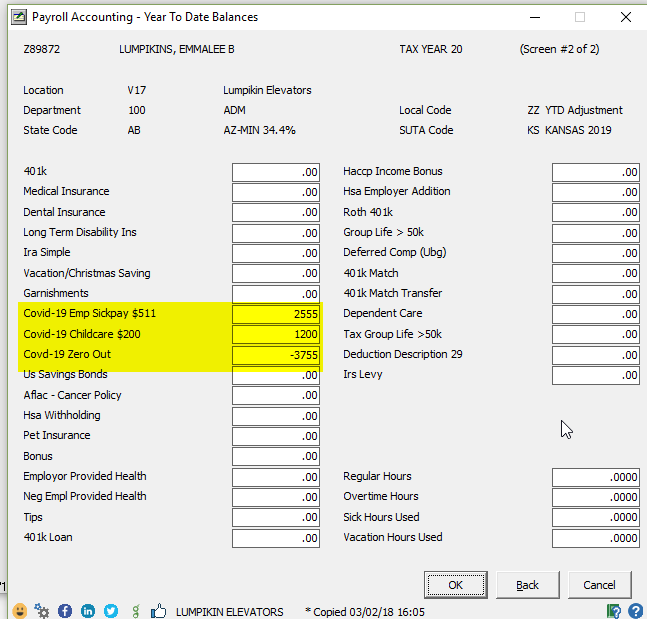

PAY > Employees > YTD Balance >

Note the existing year balance for the location – department – state codes

Insert button > Key year & the same location – department – state but add the ZZ as the local code.

NOTE: If editing an existing YTD record, key the exact year-location-department-state-local codes. You will be told that you cannot insert an existing year. Key an <E> in the box to the far right to open the balance record for editing. Only use this to fix the Adjustment Balance.The net pay amount of most adjustments comes out to zero.

Use <Next> and <Back> to move between the tax & deductions screen.

Use OK to save the edits.

Go to the Deductions Screen 2.

Add the dollars paid in Covid-19 Personal Sick time ($511/day limit)

Add the dollars paid in the Covid-19 Childcare pay ($200/day limit)

Add both these fields together and enter the amount as a negative amount ( in the Covid-19 Zero out)

Net effect to YTD wages is zero.Now there are 2-YTD lines for the employee.

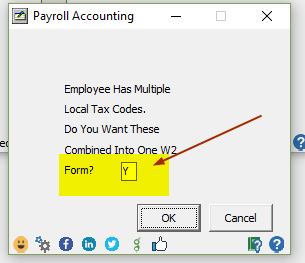

These will be added together at time of W-2 Printing.Printing of W-2 Forms will need to be flagged to combine the Local Codes so that our paycheck detail YTD Balance and our Edited YTD balance will be on same form.

...